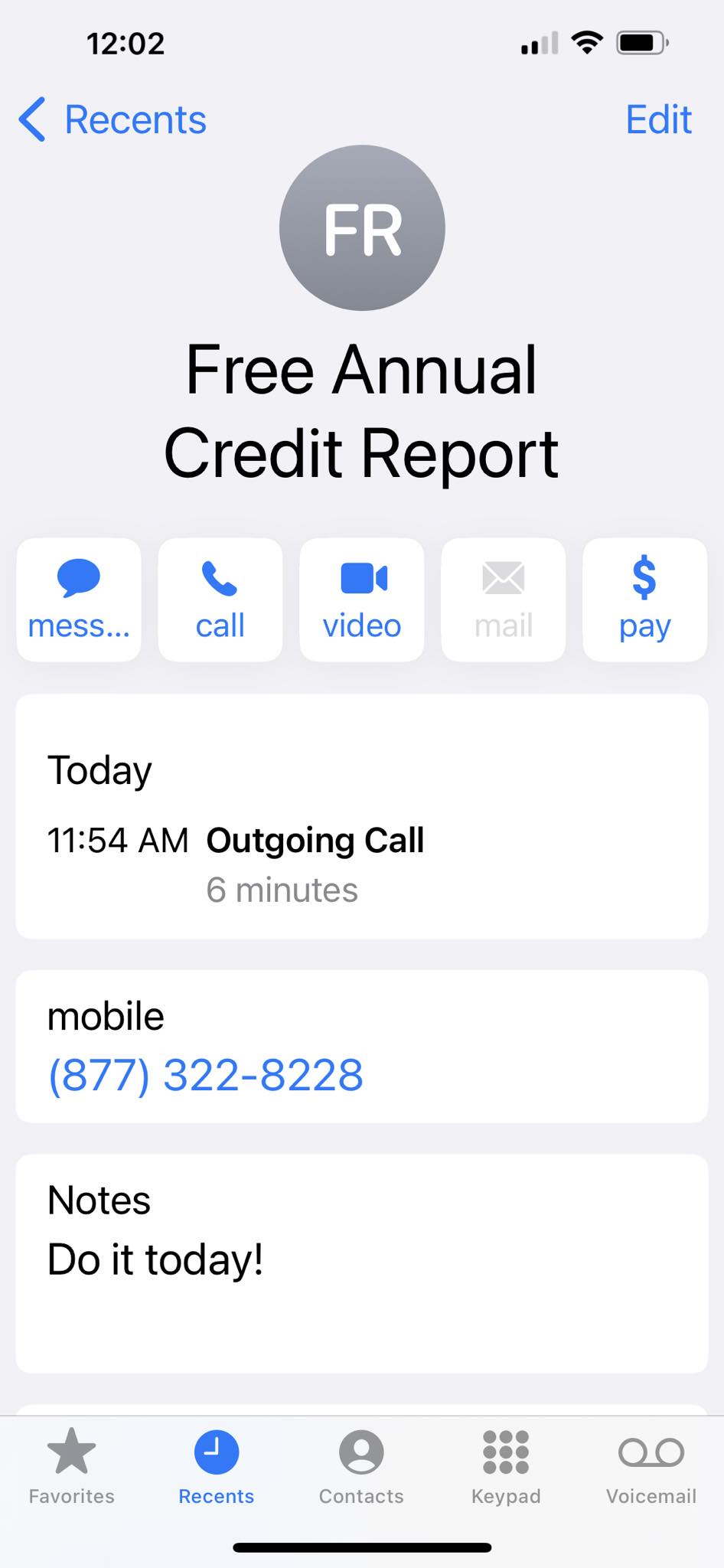

I woke up today to a weird alarm and reminder on my calendar. Ah! It’s that time again. It is time to order my credit reports from all three credit bureaus. So, I decided to write a blog post about it. I even took a snap shot on my phone.

Did you know?

A Free Annual Credit Report, as required by federal law. It is your right, do it today. This is the one thing I try to do every year for myself, my clients and friends and family. It is your financially responsibility and your right to receive, review and dispute and errors or discrepancies. Call today, I did just now and it took me 6 minutes. It is easy and convenient, but do not procrastinate. The process take 15 days to receive and it only starts once you have made that call! There are three credit bureaus: Equifax, Experian, and Trans Union.

But what is credit, really?

Credit is a type of financial agreement in which a borrower agrees to receive a loan from a lender, with the understanding that they will repay the loan, plus interest, at a later date. Credit can be used to finance a wide range of purchases, including homes, cars, education, and even everyday expenses.

There are several different types of credit, including secured credit, which is backed by collateral such as a car or a home, and unsecured credit, which is not backed by collateral. Credit can also be classified as revolving credit, which allows borrowers to borrow and repay money over and over again, or non-revolving credit, which is a one-time loan that must be repaid in full.

How to build Credit

To build credit, it’s important to establish a credit history. This can be done by applying for a credit card or a loan and making regular, on-time payments. It’s also important to use credit responsibly by not borrowing more than you can afford to repay and avoiding high balances on credit cards.

Another way to build credit is to become an authorized user on someone else’s credit account. This allows you to build credit by borrowing and repaying money on an existing credit account. It’s important to note, however, that if the primary account holder misses payments or racks up a high balance, it can negatively impact your credit score as well.

In addition to borrowing and repaying money, there are a few other factors that can impact your credit score, including the length of your credit history, the types of credit accounts you have, and the number of credit inquiries you have on your credit report.

How to monitor your Credit?

It’s important to monitor your credit score regularly, as it can impact your ability to borrow money and may even affect your ability to get a job or an apartment. There are several websites and credit monitoring services that can help you track your credit score and get tips for improving it. But simply call the toll free number: 1-877-322-8228 or go to their website: https://www.annualcreditreport.com/index.action

*Note: this is an automated system, and when asked “what reports you want,” it is important that you say “all three.”

Call today, once you have the all three reports in your hands, call me, so that we can review them in detail.

I did it today and it took me 6 minutes. I took this screen shot.

Do it today!

Building credit takes time and requires discipline, but it can have a big impact on your financial well-being. By using credit responsibly and making regular, on-time payments, you can establish a strong credit history and improve your credit score, which can make it easier to borrow money and access other financial opportunities.

Are you ready to work with me to achieve your real estate goals?

Juan Jose Cervantes

510.485.3893

jose.cervantes@cbnorcal.com

CalDRE#01410052

#GotRealEstate

Jan 7, 2023

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link