What You Need to Know Before Selling

Inheriting a home can be both a financial blessing and an emotional burden. While a property inheritance may offer new opportunities, it can also come with unexpected costs, legal complexities, and difficult decisions.

If you have inherited a property in California and are considering selling, understanding Proposition 19 and how it affects property taxes and transfers is essential. This guide will walk you through the key steps in selling an inherited home, explain the impact of Prop 19, and provide real-world examples to help you make the best decision for your situation. I am a wealth of information. Reach out to me anytime if you have any questions, please don’t hesitate.

Understanding the Reality of Today’s Real Estate Market

The California real estate market is constantly shifting. In some areas, home values have soared, making it an excellent time to sell. In others, high interest rates and economic uncertainty have made buyers more cautious. If you’ve inherited a property, you may be wondering: Should I sell now, rent it out, or keep it?

That’s where I come in. As an experienced real estate professional in Northern California, I can help guide you through the process, whether you choose to sell, rent, or explore alternative options. Let’s dive into what you need to know.

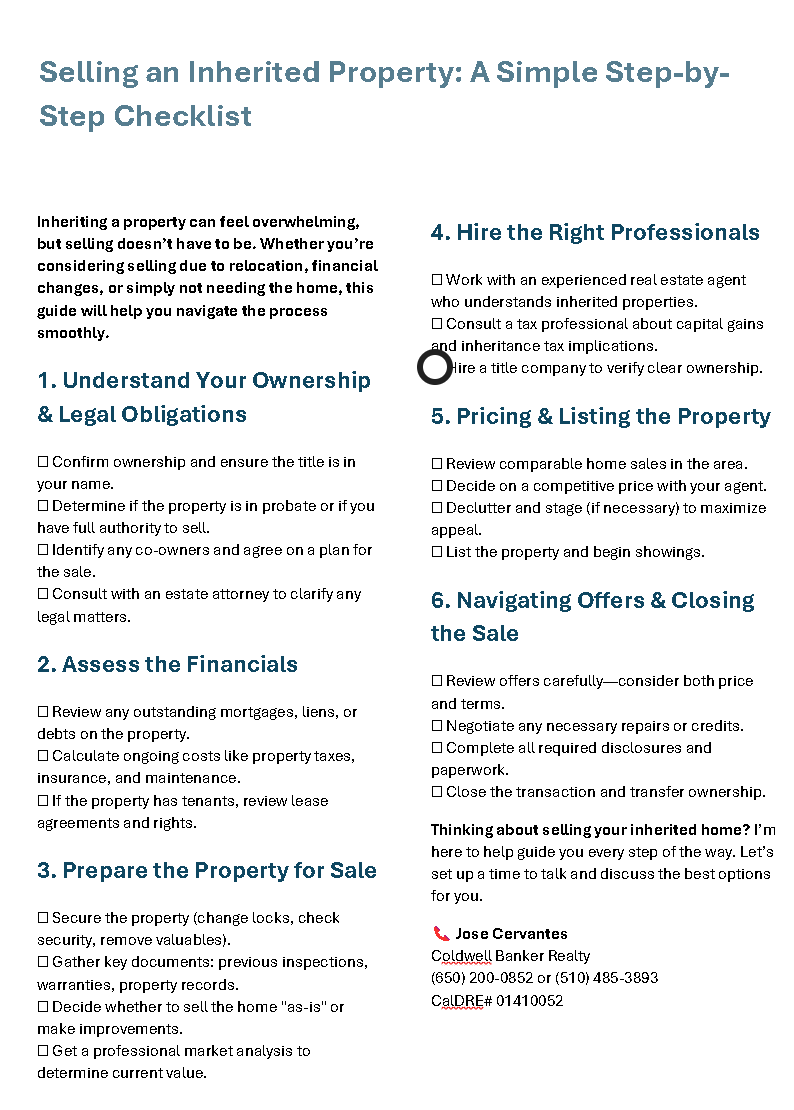

Step-by-Step Checklist for Selling an Inherited Property in California

1. Understanding Ownership & Legal Obligations

Before making any decisions, verify who legally owns the property. Some homes pass automatically to heirs, while others may require probate. If multiple heirs are involved, discuss whether everyone agrees to sell or if someone wishes to keep the home.

Example: Sarah and her brother inherited their mother’s home in San Mateo. While Sarah wanted to sell, her brother was hesitant. After discussing options with a real estate expert, they agreed to a buyout arrangement that allowed her brother to keep the home while compensating Sarah for her share.

Key Action Steps:

- Confirm if the property is in probate.

- Check if there’s a will or trust in place.

- Consult with an estate attorney if needed.

2. Assess the Financials: Mortgage, Liens & Taxes

Inherited properties often come with financial responsibilities. Before listing the home, determine:

- Are there any outstanding mortgages?

- Are there property tax implications under Proposition 19?

- Are there unpaid liens or HOA fees?

How Proposition 19 Impacts Inherited Properties

What is Prop 19? Proposition 19, which went into effect on February 16, 2021, changed how property tax transfers work in California. Previously, children or grandchildren could inherit a home and maintain the original property tax basis, keeping taxes low. However, under Prop 19:

- The property tax reassessment exemption only applies if the inherited home becomes the primary residence of the heir(s).

- If the home is kept as a rental or second home, it will be reassessed at the current market value—which can lead to significantly higher property taxes.

Example: John inherited his parents’ home in Burlingame, where they had lived for 40 years. Their property taxes were based on a value of $150,000. If John moved into the home, he could keep the low tax rate under Prop 19. However, if he decided to rent it out, the property would be reassessed at today’s market value of $2.1 million, dramatically increasing property taxes.

Potential Solutions:

- Sell the property now to avoid high property taxes.

- Move into the home and claim the tax exemption.

- Consider a 1031 Exchange if converting the property into an investment.

- Explore co-ownership options if multiple heirs are involved.

3. Preparing the Property for Sale

3. Preparing the Property for Sale

Once you’ve made the decision to sell, preparing the home is crucial to maximizing its value. Unlike standard sales, inherited properties may need additional work to clear out personal belongings, make repairs, and stage the home for buyers.

Checklist:

- Secure the property (change locks, check utilities).

- Gather key documents (title, past inspections, insurance policies).

- Decide whether to sell “as-is” or make improvements.

- Get a professional home valuation to understand market value.

4. Listing & Selling the Home

Now comes the final steps 4, 5, and 6 —putting the home on the market and getting it sold. This is where you must hire a professional. I have a great video, titled Who is your Realtor? Please take a look and subscribe to my channel.

The right pricing strategy is critical. Overpricing can lead to a stale listing, while underpricing can leave money on the table. I’ll provide a customized market analysis and the best strategy to sell quickly and for top dollar.

Example: Lisa inherited her grandparents’ home in Redwood City but wasn’t sure how to sell it quickly. She worked with me to price it strategically, market it effectively, and negotiate multiple offers. Within 14 days, the home sold above the asking price, allowing Lisa to move forward with confidence.

What’s Next? Let’s Chat!

Selling an inherited property can be complex, but you don’t have to navigate it alone. Whether you’re just exploring options or ready to take action, I’m here to guide you.

📞 Let’s schedule a quick call or in-person meeting to discuss your options. I can help you avoid costly mistakes and make the best decision for your future.

👉 Call/Text: (650) 200-0852 or (510) 485-3893

👉 Email: jose.cervantes@cbnorcal.com

👉 Website: www.GotRealEstate.us

Jose Cervantes

Coldwell Banker Realty | Team Tapper

CalDRE# 01410052

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link

3. Preparing the Property for Sale

3. Preparing the Property for Sale